What Factors Affect Gold’s Price?

January 3, 2023

The characteristics of gold as an inflation haven and a store of value gets investors rushing to have a portion in their portfolios particularly during periods of economic downturns.

Gold is a scarce commodity the reserves of which are not abundant. This and other characteristics play a role in determining the price gold sells for on the market.

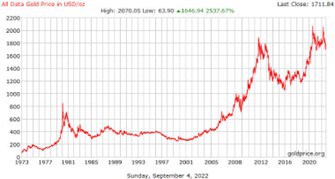

In January 2020, before the Covid-19 pandemic, an ounce of gold traded for $1530. Towards the end of July and wary August, the price of gold skyrocketed to a massive $2035 — an all time high. Factors such as changing fiscal policies, investors’ panic, and the instability in the equity market were the major drivers of the surge in gold price.

These factors derive from the inherent value in every gold bar.

A look at some of these factors:

Supply and Demand

Like every commodity, market forces of supply and demand greatly impact the price of gold. Gold is sought after for a number of reasons which includes its use in the production of goods such as jewelry, manufacture of electric devices, coating of medical equipment and dental aesthetics. Demands also extend to its use as an inflation hedge and for market trade for ETFs.

In recent times demand for gold has increased majorly by nations such as Turkey, China, Russia, and India. These increasing demands tend to drive up the price of gold higher.

Fiscal Policies

Government policies portray the economic outlook of a country to investors. Expansive policies during economic downturns such as those seen during the Covid-19 pandemic lead to an idea of future inflationary trends. This drives investors to seek a haven in gold backed assets leading to a rise in the price of gold.

US-Dollar

Prior to the US ditching the gold standard, the value of the dollar was pegged to the price of gold. After abandoning the gold standard for fiat currency in 1971, the dollar assumed an inverse correlation to gold. Many nations have similarly adopted fiat currencies

While the fiat currency gives government freedom over their monetary policies, it has led to it being subject to inflationary forces. During this period, the trust in fiat currency reduces leading investors to turn towards gold. This leads to an increase in gold price. Inversely when the value of the dollar increases, gold price tends to fall.

However, in recent times, the price of gold and the dollar have both risen higher.

Investment option

Asides being an inflation haven, gold also trades as ETFs of mining stocks and gold companies. The World Gold Council estimates the amount of gold traded in various investment forms from 2017 to 1,271.7 tones, a total of 29% in the demand for gold.

The SPDR Gold Trust is the largest holder of gold shares and holds a massive 1,078 tones of gold.

Inflation and Market Volatility

Market volatility in difficult financial periods leads to an increased interest in portfolio diversification. Investors tend to seek other investment options away from volatile and risky ones to safe havens such as precious metals.

Gold has traditionally been seen as a store of value and an asset for diversification. Also in inflationary trends commodities lose their value foreboding a bad future outlook for the astute investor.

These factors lead to an increased demand for gold causing a rise in the price of gold.

Central bank reserve

Global central banks account for a major holding in gold stores holding 35,500 metric tons (one-fifth of total gold mined). The World Gold Council survey revealed that 61% of central bank staff expect an increase in gold reserves over the next 12 months.

The central banks are saddled with the responsibility of ensuring economic stability and no better asset does that than gold. Gold is favored for its good performance in periods of economic volatility.

Some of the Countries with the largest gold reserves include the United State, China, Russia, and Germany.

As the purchase of gold by central banks increases the price of gold tends to increase.

Tax and Trading Cost

The tax on mining, holding, transportation of gold has an influence on the prevailing price of gold. With newer technology to discover new gold stores, there is an increasing cost of production and an increase in price.

Gold mining

It is estimated that approximately 2,500,000 to 3,000,000 kilograms of gold is mined each year to the existing amount of available gold. This supply is inadequate to meet the high demand of gold by investors and consumers of gold products yearly. When the supply of gold do not meet the demands the price of gold tends to increase.

Also, it takes a lot of digging to access newer stores of gold leading to more occupational hazard exposure to miners. This and other logistics add to the cost of gold mining further driving up gold prices.

Conclusion

The price of gold is driven by a number of factors from demand for gold products to inflation trends. Periods of economic downturns lead to increased demand for gold and ultimately drive up the price of gold.

The 2020 pandemic and market collapse led to an all-time high in gold price due to increased market volatility as investors sought a safe haven in gold. Contact a Precious Metals Specialist today by filling the form out on the right or by calling 888-503-1553.